When you make an assignment into bankruptcy, you are required to make a surplus income payment. This is a contribution to your estate each month based on your monthly net take home income. Somewhat of a confusing term, as surplus income is based on your net take home pay on a monthly basis and not based on what available funds you may have left after you pay your monthly bills. Surplus income is accumulated in a trust account through the bankruptcy. It is dispersed amongst all your creditors at the end of the process. Surplus income is important because it will determine how long your bankruptcy is, and what payments are required. We will cover what surplus income is and how it is calculated.

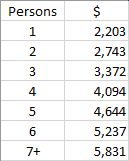

In order to calculate surplus income, we have to establish what household income is first. Household income includes amounts received (or excludes amounts paid) for child support, spousal support, child care and medical condition expenses by anyone in the family unit. The family unit is considered anyone living with the person filing that benefits from the income earned or expenses incurred, or those who contribute to such income or expenses. Surplus income is the amount of household income that a family unit brings in above the standard. The standard is an amount set by the Office of the Superintendent of Bankruptcy. It is an amount the government decides will provide a reasonable lifestyle, and it applies across the country. It is updated every April. The standard for 2019 is set like this:

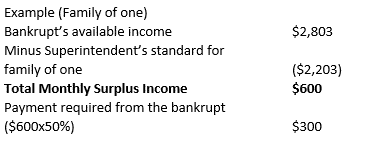

From here, it is fairly simple to calculate the amount of surplus income you owe. You would subtract the standard from your household income, and the surplus income owing is 50% of this remainder. Let’s look at an example:

The directive does allow a bit of wiggle room from these numbers. Specifically, if the monthly surplus is less than $200.00, there is no need to pay any amounts of surplus (the length of time in bankruptcy will be less this way as well). If there is more than $200.00 of surplus each month, than you are required to make surplus income payments. The Licensed Insolvency Trustee uses the average monthly income to calculate this amount. For every dollar that a family unit makes above the standard, they are responsible for paying 50% of it as a surplus income payment.

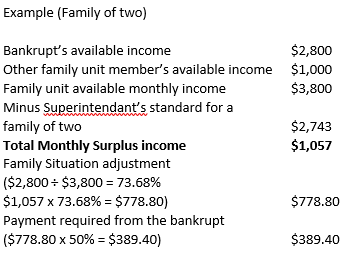

In a household with more than one person earning income, there is a family situation adjustment that calculates the amount that must be paid. It is adjusted to the same percentage as the bankrupt’s portion of the family unit’s available monthly income. Let’s look at an example to illustrate these calculations (this example, and others, are available here):

This example illustrates how the bankrupt’s income is used to figure out the exact percentage (73.68%) of the surplus that they owe each month. This makes for a total surplus income payment of $389.40. Surplus income can be a bit tricky to calculate, and can fluctuate if your income is inconsistent.

We recommend that you come in for a free consultation. A free consultation will give us the chance to explain anything further in regards to surplus income. As well, we can look to see if a consumer proposal would better suit your needs. If you are struggling financially and looking to make a change, contact us today. We can help alleviate your stress and start working towards your FreshStart!