This is a popular time of year for comparing a RRSP (Registered Retirement Savings Plan) and a TFSA (Tax Free Savings Account), so we are diving right into it! Many people wonder whether they are better off investing through a RRSP, a TFSA, or both, and our post will explain the differences and shed some light on what may work best for you. No matter what you choose, the fact you are planning on how to save money is a great start!

How do the RRSP and TFSA compare?

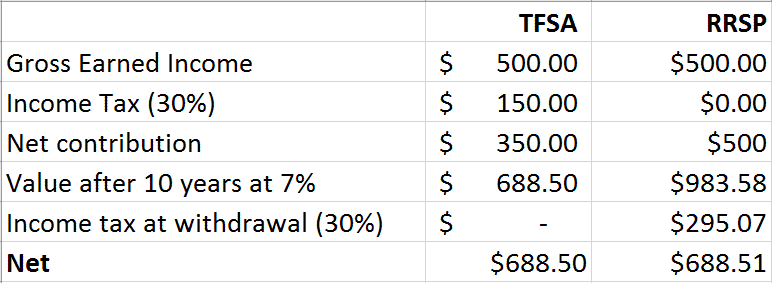

The biggest difference between the two accounts is how income taxes effect them. RRSP’s are tax-deferred. Tax-deferred means you can contribute with pre-tax income, and you pay income tax when you make a withdrawal. The TFSA is a tax free account, so this means you invest your after-tax income. Since you have paid taxes on this money before investing, you do not need to pay taxes when you make a withdrawal. Any earnings on this account would be tax exempt. Although both are taxed differently, we can see with the use of the following example that you can end up in close to the same spot (depending on your tax rates for the RRSP).

This table does make a couple of assumptions, including your marginal tax rate during retirement. This may be difficult to know if you are younger and just beginning your prime earning years. The main point here is that the accounts can be quite similar, so we want to compare the major differences.

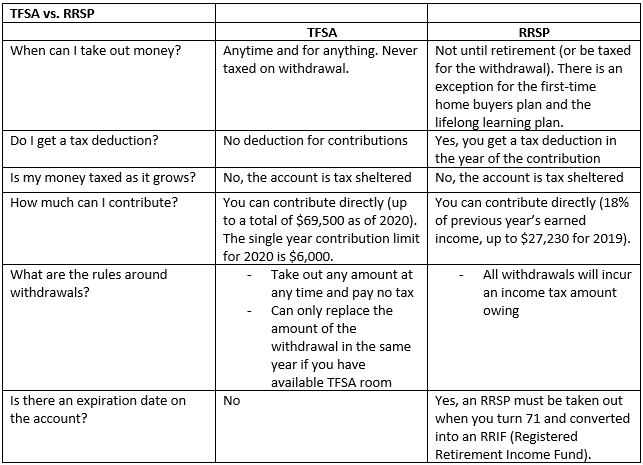

Both accounts will allow you to hold a variety of investments, but the major difference is the amount you can contribute to each, and how withdrawing funds work. Here is a handy table comparing the RRSP and TFSA:

A bit more about the TFSA

The Tax Free Savings Account was introduced in 2009 as another means for Canadians to make saving a priority. It is great to use for saving for retirement; however, due to the tax rules involved, it is a great savings tool for shorter term goals as well. This is because there are no tax implications when you make a withdrawal! Here are a few more facts about TFSA’s.

- You can open a TFSA once you turn 18 years old

- If you make a withdrawal, the contribution room is returned the following year

- In retirement, the government will claw back your OAS when you start withdrawing from your RRSP. This is not the case with a TFSA

- TFSA’s are fully seizable under the Bankruptcy and Insolvency act

A bit more about the RRSP

The Registered Retirement Savings Plan was introduced in 1957 as a way to get Canadians saving for their retirement. There are tax implications for any withdrawn amounts before retirement, with the exception of withdrawing funds under the Home Buyers Plan (HBP) and the Lifelong Learning Plan (LLP), which allow you to borrow funds from your own RRSP’s tax free. Here are a few more facts about those plans and RRSP’s.

- Home Buyers Plan allows first time home buyers to withdraw up to $35,000 from their RRSP. You can withdraw funds from more than one RRSP, as long as you are the owner. If you have a partner with an RRSP, you can both withdraw $35,000 to total $70,000. There are a few more rules and restrictions to know that you can read here.

- Lifelong Learning Plan requires students to be full time, participating in qualifying education programs and enrolled at a designated education institution. More detailed rules and restrictions are available to read here.

- You get a tax deduction in the year you contribute to your RRSP. In order to take full advantage of this, investing the tax refund is a must.

- RRSP’s are more beneficial for those in higher tax brackets. This can decrease your tax burden in the year of contribution, and ideally, you will be in a lower tax bracket when you withdraw in retirement. A win-win!

- RRSP’s are exempt under the Bankruptcy and Insolvency Act, with the exception of contributions made in the 12 months previous.

What does it all mean?

As you can tell, there are a lot of variables at play when it comes to investing for our future. It’s great you have decided to save. That’s the big first step! The next step would be to speak to a professional to see what investment vehicle(s) are best for your situation going forward. This way you can ensure the money you work so hard to save, is growing and ready to benefit you in the best way possible.

If you’re in too big of a financial hole to worry about comparing a RRSP and a TFSA, come see us for a free 45 minute consultation. It could be the only step you need to make to get working towards your FreshStart!